Taxes and Millage Rates

Find out more information about sales tax, property tax and millage rates here.

Find out more information about sales tax, property tax and millage rates here.

El Dorado (in city limits) 9.75%

Out of city limits 8.5%

Union County 2%

State of Arkansas 6.5 %

Visit the Arkansas Department of Finance and Administration website (click here) to view more tax rates for the state of Arkansas.

Property taxes due= assessed value X millage rate

Property is assessed at 20% of the actual value.

For Example:

If a person has a $100,000 home, it would be assessed at 20% of the actual value, $20,000. That assessed value ($20,000) is then multiplied by the millage rate, depending on the school district that the property is located in, to determine the amount of taxes.

$100,000

X 20%

$20,000

$20,000

X .0455 (located in the City of El Dorado)

$910 taxes

Automobiles are also assessed at 20% of market value based on the value of the vehicle on Jan. 1 of the current year. Taxes are calculated the same.

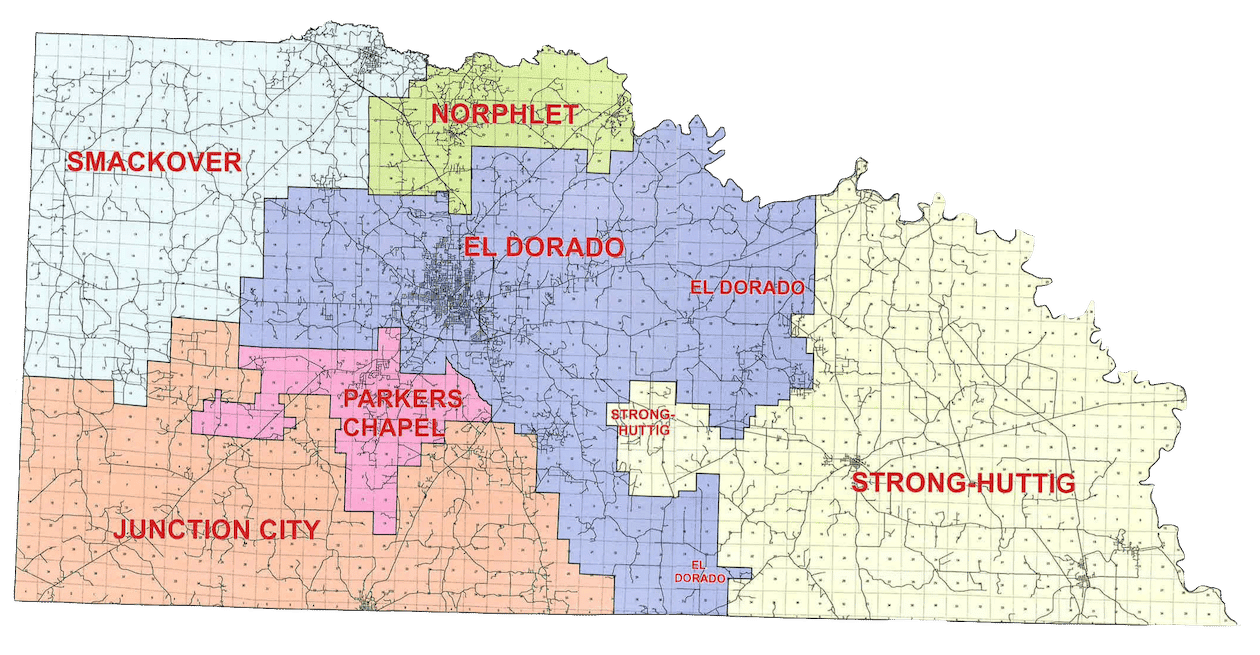

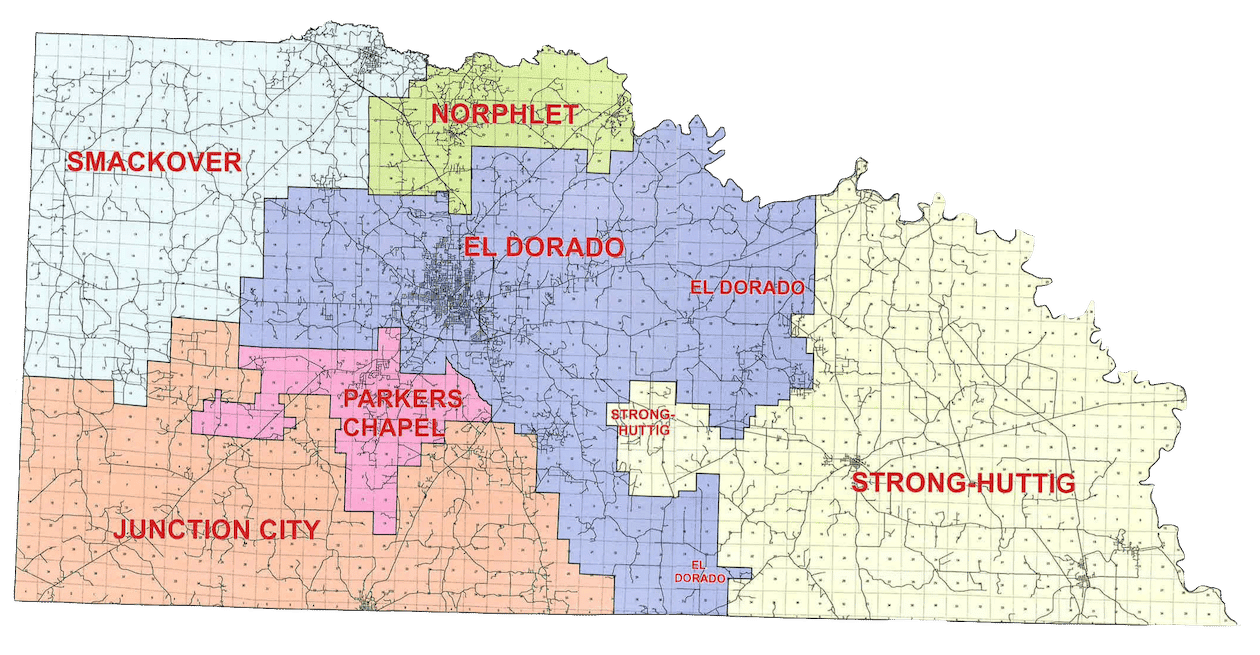

El Dorado School District

Outside city limits 40.5

Inside El Dorado city limits 45.5

Smackover School District

Outside city limits 48.0

Inside Smackover city limits 53.0

Parkers Chapel School District 39.8

Junction City School District

Outside city limits 42.0

Inside Junction City limits 47.0

Strong-Huttig School District

Outside city limits 46.0

Inside Strong city limits 51.4

Inside Huttig city limits 51.8

|Inside Felsenthal city limits 51.0

Norphlet School District

Outside city limits 49.0

Inside Norphlet city limits 54.3

Inside Calion city limits 55.0